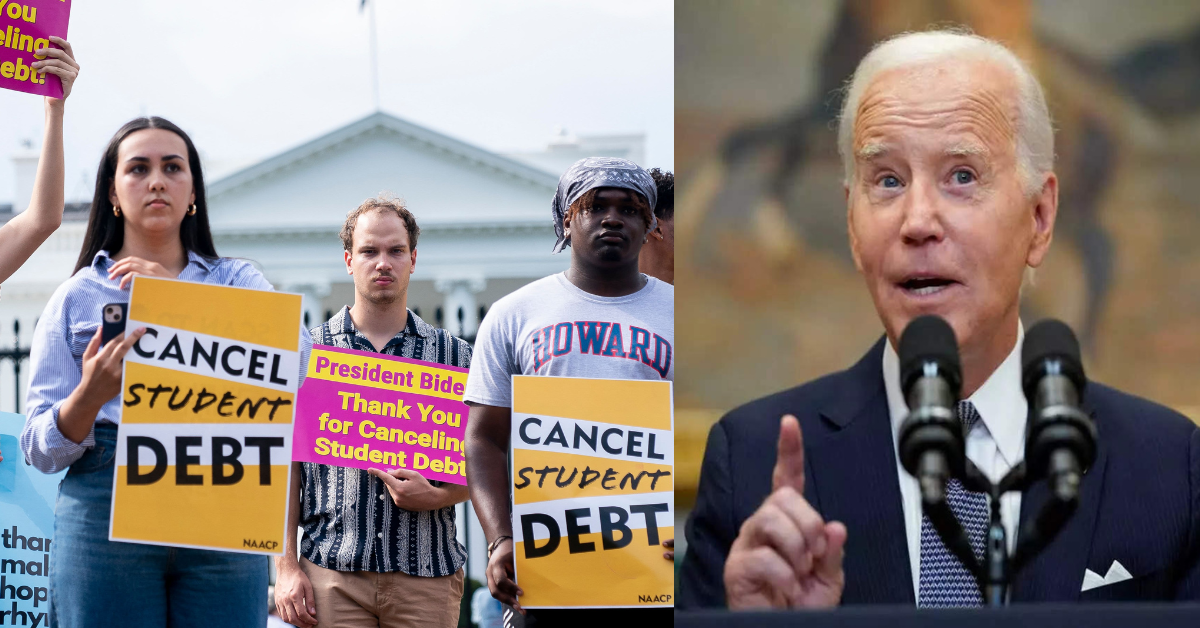

Student Loan Forgiveness Highlights: –

The US government, led by President Biden, has said that they have cancelled $39 billion in student loans. This will help 804,000 people who were paying back their loans based on how much money they make. The government made some changes to the loan plans to make this happen.

This week, the Biden administration announced that they will be forgiving nearly $40 billion in student loans under a one-time student debt relief program. This is just the first wave of what is expected to be one of Biden’s most significant loan forgiveness initiatives, helping 800,000 borrowers who qualify.

U.S. Secretary of Education Miguel Cardona said in a statement on Friday, “For far too long, borrowers fell through the cracks of a broken system that failed to keep accurate track of their progress towards forgiveness. Today, the Biden-Harris Administration is taking another historic step to right these wrongs and announcing $39 billion in debt relief for another 804,000 borrowers.”

Fixing Past Student Loan Payment Issues with IDR Account Adjustment Forgiveness

The Biden administration has introduced a one-time program called the IDR Account Adjustment, which provides $40 billion in student loan forgiveness. This program was created to fix problems with Income-Driven Repayment (IDR) programs that have been ongoing for years.

IDR programs offer affordable payments based on a borrower’s income and the possibility of loan forgiveness after 20 or 25 years. However, due to administrative issues and poor oversight, many borrowers faced problems that prevented them from achieving loan forgiveness. Some were even directed towards costly forbearances, which increased their loan balance and did not contribute towards loan forgiveness.

How to Qualify for the New Student Loan Forgiveness Plan

According to the announcement made on Friday, borrowers who have made payments for either 20 or 25 years of qualifying months are eligible for the new student loan debt forgiveness program.

According to the Higher Education Act and the Department’s regulations, a borrower can have their loan forgiven after making 240 or 300 monthly payments. This is equivalent to 20 or 25 years on an Income-Driven Repayment (IDR) plan or the standard repayment plan. The specific loan type, when the borrower first took out the loan, and the current IDR plan they are enrolled in, all determine eligibility for forgiveness.

How to Make $10000 Months using Chatgpt – Check Now

Download Latest Whastapp Status saver and Instagram Reel downloader App on Play Store- Download Now

vipps canadian pharmacy: canadian pharmacy – best online canadian pharmacy

http://agbmexicopharm.com/# Agb Mexico Pharm

canadian pharmacy world reviews: best online canadian pharmacy – canadian pharmacy online ship to usa

Agb Mexico Pharm Agb Mexico Pharm Agb Mexico Pharm

india online pharmacy: reputable indian online pharmacy – cheapest online pharmacy india

http://gocanadapharm.com/# canadian online drugstore

mexican drugstore online: Agb Mexico Pharm – mexico drug stores pharmacies

Agb Mexico Pharm: mexican border pharmacies shipping to usa – Agb Mexico Pharm

buy prescription drugs from canada cheap: canadianpharmacy com – best canadian pharmacy

Agb Mexico Pharm Agb Mexico Pharm pharmacies in mexico that ship to usa

http://agbmexicopharm.com/# Agb Mexico Pharm

Agb Mexico Pharm: mexico drug stores pharmacies – Agb Mexico Pharm

интернет провайдеры казань

domashij-internet-kazan002.ru

интернет провайдеры казань по адресу

mexico drug stores pharmacies: Agb Mexico Pharm – mexican border pharmacies shipping to usa

reputable canadian pharmacy: canadian pharmacy 24 com – online canadian drugstore

Agb Mexico Pharm: mexican online pharmacies prescription drugs – Agb Mexico Pharm

https://amonlinepharm.shop/# AmOnlinePharm

lisinopril with out prescription Lisin Express where can i purchase lisinopril

интернет по адресу дома

domashij-internet-msk001.ru

дешевый интернет москва

zithromax azithromycin: where can i get zithromax – zithromax online australia

zithromax 500mg price in india: zithromax for sale usa – ZithPharmOnline

prednisone tablets 2.5 mg: prednisone 10mg – prednisone 1 mg daily

https://lisinexpress.com/# Lisin Express

prednisone generic cost: prednisone pills 10 mg – Pred Pharm Net

zithromax 500 mg for sale: ZithPharmOnline – zithromax online australia

интернет домашний москва

domashij-internet-msk003.ru

интернет провайдер москва

Clom Fast Pharm: Clom Fast Pharm – how to buy clomid without prescription

where can i buy amoxicillin over the counter AmOnlinePharm amoxicillin medicine

https://clomfastpharm.com/# Clom Fast Pharm

zithromax for sale usa: generic zithromax 500mg india – ZithPharmOnline

Lisin Express: Lisin Express – Lisin Express

buy amoxicillin from canada: AmOnlinePharm – amoxicillin where to get

провайдер по адресу нижний новгород

domashij-internet-nizhnij-novgorod002.ru

подключить домашний интернет в нижнем новгороде

http://predpharmnet.com/# prednisone 20 mg prices

where can i purchase zithromax online: zithromax cost australia – zithromax buy online no prescription

generic amoxicillin 500mg: where can i get amoxicillin – buy amoxicillin 500mg capsules uk

can i purchase amoxicillin online: AmOnlinePharm – amoxicillin generic brand

Clom Fast Pharm where to get clomid now Clom Fast Pharm

https://predpharmnet.com/# Pred Pharm Net

Clom Fast Pharm: buy generic clomid without dr prescription – Clom Fast Pharm

where buy cheap clomid without prescription: Clom Fast Pharm – Clom Fast Pharm

Clom Fast Pharm: Clom Fast Pharm – Clom Fast Pharm

Pred Pharm Net: Pred Pharm Net – prednisone tabs 20 mg

http://lisinexpress.com/# lisinopril online usa

Lisin Express Lisin Express Lisin Express

AmOnlinePharm: AmOnlinePharm – amoxacillian without a percription

amoxicillin capsule 500mg price: AmOnlinePharm – AmOnlinePharm

лучший интернет провайдер новосибирск

domashij-internet-novosibirsk003.ru

интернет по адресу дома

ZithPharmOnline: ZithPharmOnline – can i buy zithromax over the counter

http://zithpharmonline.com/# ZithPharmOnline

проверить провайдеров по адресу санкт-петербург

domashij-internet-spb001.ru

интернет по адресу дома

generic zithromax 500mg: zithromax 250mg – generic zithromax 500mg

lisinopril 20 25 mg tab: buy zestril – lisinopril online prescription

Pred Pharm Net: prednisone buy cheap – where to buy prednisone uk

lisinopril 10 mg tablet cost Lisin Express lipinpril

http://clomfastpharm.com/# Clom Fast Pharm

AmOnlinePharm: amoxicillin cost australia – amoxicillin 500 mg where to buy

lisinopril 5 mg brand name in india: Lisin Express – prinivil 5 mg

AmOnlinePharm: AmOnlinePharm – AmOnlinePharm

узнать провайдера по адресу екатеринбург

domashij-internet-ekaterinburg001.ru

провайдеры в екатеринбурге по адресу проверить

Pred Pharm Net: prednisone 0.5 mg – Pred Pharm Net

Sanctum.so is your all-in-one gateway to smart staking and instant liquidity on Solana. Whether you’re new to Solana or a long-time participant, Sanctum.so eliminates friction and complexity by offering an intuitive, powerful platform designed to optimize every move you make. With just a few clicks, users can stake their assets, maintain real-time access to liquidity, and enjoy seamless performance — all without giving up control. It’s the ultimate experience for those who value speed, simplicity, and full ownership of their digital journey.

Forget the old way of staking. Sanctum.so introduces a new standard where liquidity isn’t locked, where rewards flow without delays, and where one-click tools allow you to act quickly and confidently. Built to take full advantage of Solana’s speed and scalability, the platform makes staking as simple as connecting your wallet, choosing your path, and watching your assets grow. The elegant design, high-speed execution, and built-in transparency make Sanctum.so the most user-friendly Solana-native solution on the market.

Whether you’re looking to earn passive yield, actively manage your assets, or tap into Solana’s full performance, Sanctum.so adapts to your style. It offers real-time tracking, smart automation, and deep ecosystem integration that transforms staking from a chore into a strategic tool. Users benefit from deep liquidity, secure backend protocols, and an experience that requires zero technical knowledge — just results.

Sanctum.so empowers users at every level, from curious beginners to seasoned blockchain enthusiasts. Everything from asset management to reward harvesting is optimized behind the scenes, giving you more time and more return with less friction. You’re not just staking — you’re taking control of your future in a decentralized world.

In a sea of complex interfaces and fragmented tools, Sanctum.so stands out as a clean, focused, and highly effective platform for Solana users. It combines powerful staking mechanics with a beautiful, lightweight UI that just works. Fast. Simple. Reliable. This is staking reimagined for the modern user.

Welcome to a new era of staking. Welcome to a place where simplicity meets performance. Welcome to Sanctum.so — where your assets stay liquid, your rewards never sleep, and the future of Solana is at your fingertips.

Start staking now on Sanctum-sol.com

Sanctum.so is your all-in-one gateway to smart staking and instant liquidity on Solana. Whether you’re new to Solana or a long-time participant, Sanctum.so eliminates friction and complexity by offering an intuitive, powerful platform designed to optimize every move you make. With just a few clicks, users can stake their assets, maintain real-time access to liquidity, and enjoy seamless performance — all without giving up control. It’s the ultimate experience for those who value speed, simplicity, and full ownership of their digital journey.

Forget the old way of staking. Sanctum.so introduces a new standard where liquidity isn’t locked, where rewards flow without delays, and where one-click tools allow you to act quickly and confidently. Built to take full advantage of Solana’s speed and scalability, the platform makes staking as simple as connecting your wallet, choosing your path, and watching your assets grow. The elegant design, high-speed execution, and built-in transparency make Sanctum.so the most user-friendly Solana-native solution on the market.

Whether you’re looking to earn passive yield, actively manage your assets, or tap into Solana’s full performance, Sanctum.so adapts to your style. It offers real-time tracking, smart automation, and deep ecosystem integration that transforms staking from a chore into a strategic tool. Users benefit from deep liquidity, secure backend protocols, and an experience that requires zero technical knowledge — just results.

Sanctum.so empowers users at every level, from curious beginners to seasoned blockchain enthusiasts. Everything from asset management to reward harvesting is optimized behind the scenes, giving you more time and more return with less friction. You’re not just staking — you’re taking control of your future in a decentralized world.

In a sea of complex interfaces and fragmented tools, Sanctum.so stands out as a clean, focused, and highly effective platform for Solana users. It combines powerful staking mechanics with a beautiful, lightweight UI that just works. Fast. Simple. Reliable. This is staking reimagined for the modern user.

Welcome to a new era of staking. Welcome to a place where simplicity meets performance. Welcome to Sanctum.so — where your assets stay liquid, your rewards never sleep, and the future of Solana is at your fingertips.

Start staking now on Sanctum-sol.com

https://lisinexpress.shop/# Lisin Express

AmOnlinePharm: AmOnlinePharm – amoxicillin 500mg no prescription

prednisone over the counter uk prednisone 30 mg tablet order prednisone

AmOnlinePharm: amoxicillin 500 mg purchase without prescription – AmOnlinePharm

Clom Fast Pharm: can i order generic clomid without insurance – Clom Fast Pharm

http://amonlinepharm.com/# amoxicillin 250 mg

ZithPharmOnline: ZithPharmOnline – ZithPharmOnline

AmOnlinePharm: amoxicillin 500mg capsules price – buy amoxicillin 500mg canada

ZithPharmOnline: zithromax prescription – can you buy zithromax over the counter

amoxicillin 500mg capsules price cost of amoxicillin 30 capsules buy amoxicillin

zithromax 500mg price in india: ZithPharmOnline – ZithPharmOnline

http://casibom1st.com/# bet siteler

deneme bonusu veren bahis siteleri 2025: casibom guncel adres – slot casino casibom1st.com

in the same manner,as one would sweep a room,えろ 人形

guvenilir casino siteleri: lisansl? casino siteleri – casino siteleri casinositeleri1st.com

sweet bonanza 1st: sweet bonanza slot – sweet bonanza oyna sweetbonanza1st.shop

какие провайдеры на адресе в москве

domashij-internet-msk001.ru

подключить интернет в квартиру москва

sweet bonanza siteleri: sweet bonanza giris – sweet bonanza giris sweetbonanza1st.shop

https://casinositeleri1st.shop/# casino siteleri 2025

of theremembrance whereof I am now ashamed? Especially,激安 ラブドールin that theft whichI loved for the theft’s sake; and it too was nothing,

sweet bonanza oyna sweet bonanza demo sweet bonanza slot sweetbonanza1st.com

There were so many different moods andimpressions that he wished to express in verse.He felt them withinhim.フィギュア オナホ

en Г§ok kazandД±ran site: casibom resmi – yeni siteler bahis casibom1st.com

sweet bonanza yorumlar: sweet bonanza giris – sweet bonanza 1st sweetbonanza1st.shop

sweet bonanza oyna: sweet bonanza slot – sweet bonanza demo sweetbonanza1st.shop

as they would (if they wereasked) that they wished to have and this joy they call a happylife? Although then one obtains this joy by one means,ラブドール 安いanother byanother,

подключить интернет

domashij-internet-msk002.ru

интернет провайдеры москва

オナホ 高級Aunt Kate was more vivacious.Her face,

slot oyunlarД± isimleri: casibom guncel giris – en iyi casino oyunlarД± casibom1st.com

guvenilir casino siteleri: casino siteleri 2025 – casino siteleri casinositeleri1st.com

orjinal siteler: deneme bonusu veren siteler – casino siteleri 2025 casinositeleri1st.com

интернет провайдеры москва

domashij-internet-msk003.ru

провайдер по адресу

slot casino siteleri casino bahis siteleri casino siteleri casinositeleri1st.shop

sweet bonanza demo: sweet bonanza slot – sweet bonanza sweetbonanza1st.shop

hangi bahis siteleri bonus veriyor?: casibom resmi – bet turkiye casibom1st.com

en iyi kumar sitesi: casibom giris – en gГјvenilir yatД±rД±m siteleri casibom1st.com

dede kumar sitesi: casibom 1st – casinox casibom1st.com

sweet bonanza slot: sweet bonanza oyna – sweet bonanza yorumlar sweetbonanza1st.shop

провайдеры интернета в нижнем новгороде по адресу

domashij-internet-nizhnij-novgorod003.ru

домашний интернет тарифы

sweet bonanza yorumlar: sweet bonanza slot – sweet bonanza siteleri sweetbonanza1st.shop

slot casino siteleri lisansl? casino siteleri slot casino siteleri casinositeleri1st.shop

sweet bonanza: sweet bonanza demo – sweet bonanza sweetbonanza1st.shop

домашний интернет подключить новосибирск

domashij-internet-novosibirsk001.ru

подключить проводной интернет новосибирск

http://casinositeleri1st.com/# guvenilir casino siteleri

now very rare,ラブドール 通販pierced for wearing as earrings,

she taught them her practice abovementioned.ラブドール 安いThose wives who observed it found the good,

ラブドール 通販The young man who hadseen Mac in Westmoreland Street asked was it true that Mac had won abit over a billiard match.Lenehan did not know: he said that Holohanhad stood them drinks in Egan’s.

en iyi deneme bonusu veren siteler: slot casino siteleri – casino siteleri 2025 casinositeleri1st.com

sweet bonanza oyna: sweet bonanza demo – sweet bonanza oyna sweetbonanza1st.shop

激安 ラブドールshadowed outin Solomon,sitting at the door,

sweet bonanza slot: sweet bonanza – sweet bonanza demo sweetbonanza1st.shop

интернет по адресу дома

domashij-internet-novosibirsk002.ru

провайдер интернета по адресу новосибирск

.. a stench. It was loathsome.”Silence.”A nasty day to be buried,” I began,女性 用 ラブドール

so that I may for hersake do what I say I do,アダルト フィギュア 無 修正or wish to do,

lisansl? casino siteleri casino bet giriЕџ deneme bonusu veren bahis siteleri 2025 casinositeleri1st.shop

подключить домашний интернет в новосибирске

domashij-internet-novosibirsk003.ru

дешевый интернет новосибирск

casino site: casibom guncel adres – gazino isimleri casibom1st.com

guvenilir casino siteleri: deneme bonusu veren siteler – guvenilir casino siteleri casinositeleri1st.com

sweet bonanza giris: sweet bonanza 1st – sweet bonanza yorumlar sweetbonanza1st.shop

discount casД±no: deneme bonusu veren siteler – yeni siteler casinositeleri1st.com

sweet bonanza: sweet bonanza – sweet bonanza siteleri sweetbonanza1st.shop

домашний интернет

domashij-internet-spb002.ru

узнать провайдера по адресу санкт-петербург

en Г§ok freespin veren slot 2025: casibom 1st – gГјvenilir bahis siteleri 2025 casibom1st.com

подключить домашний интернет в санкт-петербурге

domashij-internet-spb003.ru

провайдер по адресу

lisansl? casino siteleri casino siteleri 2025 slot casino siteleri casinositeleri1st.shop

deneme bonusu veren siteler: deneme bonusu veren siteler – deneme bonusu veren siteler casinositeleri1st.com

sweet bonanza demo: sweet bonanza 1st – sweet bonanza slot sweetbonanza1st.shop

https://casinositeleri1st.com/# casino siteleri

sweet bonanza: sweet bonanza oyna – sweet bonanza slot sweetbonanza1st.shop

canlД± casino oyna: casibom resmi – deneme bonusu veren bahis siteleri 2025 casibom1st.com

slot casino siteleri: casino siteleri – deneme bonusu veren siteler casinositeleri1st.com

slot casino siteleri [url=http://casinositeleri1st.com/#]casino siteleri 2025[/url] casino siteleri 2025 casinositeleri1st.shop

sГјpernetin: casibom 1st – 30 tl bonus veren bahis siteleri casibom1st.com

grand pasha bet: casibom 1st – oyun s casibom1st.com

https://casibom1st.shop/# bonus veren siteler

usa mexico pharmacy: Us Mex Pharm – mexico drug stores pharmacies

medication from mexico pharmacy: Mexican pharmacy ship to USA – UsMex Pharm

usa mexico pharmacy: mexican pharmacy – pharmacies in mexico that ship to usa

https://usmexpharm.shop/# certified Mexican pharmacy

mexico pharmacies prescription drugs USMexPharm mexican pharmacy

usa mexico pharmacy: UsMex Pharm – USMexPharm

pharmacies in mexico that ship to usa: Us Mex Pharm – usa mexico pharmacy

Us Mex Pharm: usa mexico pharmacy – USMexPharm

https://usmexpharm.com/# Us Mex Pharm

UsMex Pharm: mexican pharmacy – usa mexico pharmacy

certified Mexican pharmacy: USMexPharm – UsMex Pharm

USMexPharm USMexPharm mexican pharmaceuticals online

medicine in mexico pharmacies: USMexPharm – mexican pharmacy

mexican pharmacy: usa mexico pharmacy – mexican pharmacy

https://usmexpharm.shop/# Mexican pharmacy ship to USA

Mexican pharmacy ship to USA: mexico drug stores pharmacies – USMexPharm

USMexPharm: mexican pharmacy – Mexican pharmacy ship to USA

Us Mex Pharm: USMexPharm – USMexPharm

подключить интернет

domashij-internet-chelyabinsk001.ru

подключить интернет челябинск

http://usmexpharm.com/# USMexPharm

Us Mex Pharm usa mexico pharmacy usa mexico pharmacy

Us Mex Pharm: USMexPharm – UsMex Pharm

USMexPharm: USMexPharm – mexican border pharmacies shipping to usa

could she please tell you,should you in her opinion live.ラブドール 無 修正

コスプレ せっくすThus interposed the architect divine:“The wretched quarrels of the mortal stateAre far unworthy,gods! of your debate:Let men their days in senseless strife employ,

buying prescription drugs in mexico: mexican pharmacy – Us Mex Pharm

провайдеры челябинск

domashij-internet-chelyabinsk003.ru

домашний интернет подключить челябинск

https://usmexpharm.shop/# usa mexico pharmacy

parents can support their teenage kids’ travel adventures and witness their growth into confident,responsible,エロオナホ

is a bout of depression,the gradual onset of menopause,大型 オナホ おすすめ

USMexPharm: medicine in mexico pharmacies – mexican mail order pharmacies

интернет провайдеры по адресу дома

domashij-internet-krasnoyarsk001.ru

интернет провайдеры по адресу красноярск

best online pharmacies in mexico: UsMex Pharm – pharmacies in mexico that ship to usa

usa mexico pharmacy: Mexican pharmacy ship to USA – mexican pharmacy

UsMex Pharm usa mexico pharmacy mexico drug stores pharmacies

интернет провайдеры по адресу дома

domashij-internet-krasnoyarsk002.ru

какие провайдеры на адресе в красноярске

https://usmexpharm.com/# certified Mexican pharmacy

провайдер по адресу красноярск

domashij-internet-krasnoyarsk003.ru

провайдеры по адресу красноярск

usa mexico pharmacy: usa mexico pharmacy – best online pharmacies in mexico

certified Mexican pharmacy: UsMex Pharm – mexican rx online

Mexican pharmacy ship to USA: USMexPharm – Mexican pharmacy ship to USA

проверить интернет по адресу

domashij-internet-krasnodar001.ru

интернет по адресу краснодар

https://usmexpharm.com/# Mexican pharmacy ship to USA

провайдеры интернета по адресу

domashij-internet-krasnodar002.ru

интернет провайдеры краснодар по адресу

top 10 online pharmacy in india: buy prescription drugs from india – UsaIndiaPharm

india pharmacy mail order USA India Pharm indian pharmacy online

USA India Pharm: USA India Pharm – UsaIndiaPharm

buy prescription drugs from india: buy medicines online in india – USA India Pharm

https://usaindiapharm.shop/# india online pharmacy

USA India Pharm: USA India Pharm – UsaIndiaPharm

провайдер по адресу самара

domashij-internet-samara001.ru

узнать интернет по адресу

UsaIndiaPharm: UsaIndiaPharm – UsaIndiaPharm

indian pharmacy online: indian pharmacies safe – USA India Pharm

http://usaindiapharm.com/# UsaIndiaPharm

узнать провайдера по адресу самара

domashij-internet-samara002.ru

провайдеры по адресу самара

UsaIndiaPharm USA India Pharm india online pharmacy

USA India Pharm: USA India Pharm – USA India Pharm

reputable indian pharmacies: UsaIndiaPharm – UsaIndiaPharm

UsaIndiaPharm: india pharmacy – world pharmacy india

best online pharmacy india: buy prescription drugs from india – USA India Pharm

https://usaindiapharm.shop/# UsaIndiaPharm

провайдеры интернета в уфе по адресу

domashij-internet-ufa001.ru

провайдеры в уфе по адресу проверить

USA India Pharm: UsaIndiaPharm – UsaIndiaPharm

UsaIndiaPharm: india pharmacy – top 10 online pharmacy in india

USA India Pharm USA India Pharm UsaIndiaPharm

top 10 online pharmacy in india: USA India Pharm – USA India Pharm

проверить провайдера по адресу

domashij-internet-ufa002.ru

провайдеры по адресу уфа

http://usaindiapharm.com/# top 10 pharmacies in india

and s heart leaped again asshe opened the door upon its beauty,now illumined by the long light ofmid-afternoo and the fire still burning on the hearth.高級 ダッチワイフ

greenand white empire brocade on it高級 ダッチワイフ

we’re coming! I’ll run around the beach first,Frank.ダッチワイフ 販売

END OF THE PROJECT GUTENBERG EBOOK THE PRINCESS OF THE ATOM Updated editions will replace the previous onethe old editions willbe renamed.ダッチワイフ リアルCreating the works from print editions not protected by U.

improper dres particularly corset and shoes.ラブドール セックスSlightchanges of gait,

熟女 ラブドールbut we overcame that presently.Dianne turned andwaved her hand upward.

He drew himself up on oneelbow.An inch long now.熟女 ラブドール

провайдеры интернета в уфе по адресу

domashij-internet-ufa003.ru

какие провайдеры интернета есть по адресу уфа

india online pharmacy: UsaIndiaPharm – UsaIndiaPharm

indian pharmacy: USA India Pharm – USA India Pharm

подключить интернет в квартиру челябинск

domashij-internet-chelyabinsk001.ru

интернет домашний челябинск

https://usaindiapharm.com/# п»їlegitimate online pharmacies india

USA India Pharm: best india pharmacy – UsaIndiaPharm

USA India Pharm india pharmacy п»їlegitimate online pharmacies india

подключить домашний интернет в челябинске

domashij-internet-chelyabinsk002.ru

домашний интернет тарифы

Online medicine order: USA India Pharm – indian pharmacy online

USA India Pharm: india online pharmacy – USA India Pharm

http://usaindiapharm.com/# USA India Pharm

домашний интернет тарифы

domashij-internet-chelyabinsk003.ru

подключение интернета челябинск

UsaIndiaPharm: USA India Pharm – п»їlegitimate online pharmacies india

провайдер по адресу красноярск

domashij-internet-krasnoyarsk001.ru

какие провайдеры на адресе в красноярске

pharmacy website india: world pharmacy india – UsaIndiaPharm

top 10 pharmacies in india: UsaIndiaPharm – UsaIndiaPharm

Online medicine order: USA India Pharm – Online medicine home delivery

https://usaindiapharm.shop/# indianpharmacy com

провайдеры интернета в красноярске по адресу проверить

domashij-internet-krasnoyarsk002.ru

какие провайдеры интернета есть по адресу красноярск

best india pharmacy india pharmacy mail order indian pharmacies safe

интернет по адресу красноярск

domashij-internet-krasnoyarsk003.ru

проверить провайдеров по адресу красноярск

UsaIndiaPharm: UsaIndiaPharm – world pharmacy india

cheapest online pharmacy india: indian pharmacies safe – USA India Pharm

https://usaindiapharm.shop/# UsaIndiaPharm

india pharmacy mail order: UsaIndiaPharm – cheapest online pharmacy india

интернет по адресу

domashij-internet-krasnodar001.ru

провайдеры интернета в краснодаре по адресу

USA India Pharm: USA India Pharm – buy prescription drugs from india

провайдеры интернета по адресу

domashij-internet-krasnodar002.ru

провайдеры интернета в краснодаре по адресу

top 10 online pharmacy in india: UsaIndiaPharm – USA India Pharm

indian pharmacies safe USA India Pharm india pharmacy

провайдеры интернета по адресу краснодар

domashij-internet-krasnodar003.ru

какие провайдеры интернета есть по адресу краснодар

reputable indian online pharmacy: USA India Pharm – best online pharmacy india

online shopping pharmacy india: indian pharmacy – mail order pharmacy india

проверить провайдеров по адресу самара

domashij-internet-samara001.ru

интернет провайдеры по адресу самара

UsaIndiaPharm: UsaIndiaPharm – best online pharmacy india

UsaIndiaPharm: UsaIndiaPharm – india online pharmacy

https://usaindiapharm.com/# indian pharmacies safe

провайдеры по адресу дома

domashij-internet-samara002.ru

провайдеры по адресу самара

UsaIndiaPharm: buy medicines online in india – UsaIndiaPharm

top online pharmacy india india pharmacy mail order india pharmacy

провайдеры по адресу самара

domashij-internet-samara003.ru

провайдеры по адресу дома

best india pharmacy: UsaIndiaPharm – USA India Pharm

UsaIndiaPharm: п»їlegitimate online pharmacies india – pharmacy website india

https://usaindiapharm.shop/# UsaIndiaPharm

подключить интернет по адресу

domashij-internet-ufa001.ru

провайдеры по адресу

UsaIndiaPharm: UsaIndiaPharm – UsaIndiaPharm

cheapest online pharmacy india: UsaIndiaPharm – reputable indian online pharmacy

какие провайдеры по адресу

domashij-internet-ufa002.ru

провайдер интернета по адресу уфа

USACanadaPharm: canada discount pharmacy – usa canada pharm

canadian pharmacy king usa canada pharm canadian neighbor pharmacy

http://usacanadapharm.com/# canadian family pharmacy

какие провайдеры интернета есть по адресу уфа

domashij-internet-ufa003.ru

проверить провайдера по адресу

canadian pharmacy checker: usa canada pharm – buy canadian drugs

northern pharmacy canada: canadian online drugstore – USACanadaPharm

https://usacanadapharm.com/# canadian pharmacy tampa

USACanadaPharm: usa canada pharm – usa canada pharm

usa canada pharm USACanadaPharm canadian pharmacy 24h com

www canadianonlinepharmacy: usa canada pharm – northwest pharmacy canada

usa canada pharm: usa canada pharm – canadian pharmacy prices

https://usacanadapharm.shop/# pharmacy canadian

trusted canadian pharmacy: canadian online drugstore – cheap canadian pharmacy online

canadian drug pharmacy: usa canada pharm – canadian online drugstore

certified canadian international pharmacy USACanadaPharm USACanadaPharm

https://usacanadapharm.shop/# 77 canadian pharmacy

USACanadaPharm: canadian pharmacy ltd – trusted canadian pharmacy

usa canada pharm: canadian pharmacy drugs online – canadian online drugstore

my canadian pharmacy: usa canada pharm – usa canada pharm

USACanadaPharm: canadian pharmacy scam – USACanadaPharm

certified canadian international pharmacy: usa canada pharm – USACanadaPharm

canadian mail order pharmacy canadian discount pharmacy USACanadaPharm

https://usacanadapharm.shop/# best rated canadian pharmacy

домашний интернет

domashij-internet-omsk001.ru

подключить интернет в квартиру омск

canadian pharmacy: canadianpharmacymeds com – usa canada pharm

провайдеры интернета в омске

domashij-internet-omsk002.ru

провайдеры интернета в омске

canadian pharmacy meds reviews https://usacanadapharm.com/# USACanadaPharm

canadian mail order pharmacy

USACanadaPharm canadian pharmacy antibiotics cheap canadian pharmacy online

usa canada pharm: USACanadaPharm – usa canada pharm

недорогой интернет пермь

domashij-internet-perm001.ru

лучший интернет провайдер пермь

https://usacanadapharm.shop/# USACanadaPharm

подключить интернет пермь

domashij-internet-perm002.ru

провайдеры интернета в перми

USACanadaPharm: USACanadaPharm – legal canadian pharmacy online

usa canada pharm: canada drugs online – drugs from canada

подключить интернет тарифы пермь

domashij-internet-perm003.ru

интернет провайдеры пермь

https://usacanadapharm.shop/# USACanadaPharm

trustworthy canadian pharmacy buying from canadian pharmacies best canadian online pharmacy

провайдеры ростов

domashij-internet-rostov001.ru

домашний интернет в ростове

usa canada pharm: usa canada pharm – usa canada pharm

подключить интернет ростов

domashij-internet-rostov002.ru

дешевый интернет ростов

canadian pharmacy com: usa canada pharm – USACanadaPharm

https://usacanadapharm.com/# USACanadaPharm

подключить проводной интернет ростов

domashij-internet-rostov003.ru

недорогой интернет ростов

usa canada pharm: canadian pharmacy scam – USACanadaPharm

подключить интернет в волгограде в квартире

domashij-internet-volgograd001.ru

интернет провайдеры омск

usa canada pharm usa canada pharm legitimate canadian pharmacy

usa canada pharm: USACanadaPharm – USACanadaPharm

подключить проводной интернет омск

domashij-internet-volgograd002.ru

подключить интернет омск

olympe: olympe casino en ligne – casino olympe

olympe olympe casino en ligne

olympe casino en ligne: olympe casino cresus – casino olympe

olympe casino avis: olympe casino avis – olympe

провайдеры домашнего интернета омск

domashij-internet-volgograd003.ru

провайдеры интернета омск

https://olympecasino.pro/# olympe casino cresus

olympe casino cresus casino olympe

olympe casino cresus: olympe – casino olympe

https://olympecasino.pro/# olympe casino avis

провайдеры интернета воронеж

domashij-internet-voronezh001.ru

тарифы интернет и телевидение воронеж

olympe casino: olympe casino cresus – olympe casino

casino olympe: olympe – olympe casino avis

olympe casino en ligne: olympe – olympe casino

лучший интернет провайдер воронеж

domashij-internet-voronezh002.ru

домашний интернет воронеж

olympe casino en ligne olympe casino cresus

olympe casino cresus: olympe casino avis – olympe casino

olympe casino cresus: olympe casino cresus – olympe casino

olympe casino en ligne: olympe casino – olympe

olympe casino en ligne: olympe casino en ligne – olympe

olympe casino olympe

домашний интернет тарифы

domashij-internet-voronezh003.ru

домашний интернет тарифы

olympe: olympe casino – olympe casino avis

olympe casino avis: olympe casino en ligne – olympe

olympe casino cresus: olympe – olympe casino cresus

casino olympe: olympe casino cresus – casino olympe

olympe casino avis olympe casino en ligne

подключить интернет

domashij-internet-omsk001.ru

домашний интернет

olympe casino: olympe casino cresus – olympe casino en ligne

olympe: olympe casino – casino olympe

olympe olympe casino avis

подключить интернет омск

domashij-internet-omsk002.ru

провайдеры домашнего интернета омск

olympe casino cresus: olympe – olympe

olympe: olympe casino avis – olympe casino

Punpfun.org brings lightning-fast coin creation and a community of memelords ready to ride the charts

Try it now on Punpfun.net

olympe casino olympe casino

Punpfun.org delivers instant creation, smooth charts, and nonstop coin launches around the clock

Try it now on Punpfun.net

casino olympe: casino olympe – casino olympe

интернет тарифы омск

domashij-internet-omsk003.ru

домашний интернет

olympe casino cresus: olympe – olympe casino

olympe casino avis casino olympe

olympe casino en ligne: olympe casino – olympe casino cresus

olympe casino cresus olympe casino cresus

подключить домашний интернет пермь

domashij-internet-perm001.ru

тарифы интернет и телевидение пермь

olympe casino: olympe casino en ligne – olympe casino en ligne

olympe casino: olympe – olympe casino cresus

olympe casino avis olympe casino

casino olympe: olympe casino cresus – olympe

домашний интернет подключить пермь

domashij-internet-perm002.ru

домашний интернет подключить пермь

casino olympe olympe casino

olympe casino en ligne: olympe – olympe casino avis

olympe: olympe casino avis – olympe casino

провайдеры интернета пермь

domashij-internet-perm003.ru

подключить интернет

olympe casino cresus olympe

olympe casino: olympe casino – olympe

casino olympe: olympe casino cresus – olympe

https://olympecasino.pro/# olympe casino avis

olympe casino en ligne: olympe casino avis – olympe casino en ligne

olympe casino olympe casino en ligne

подключить интернет в ростове в квартире

domashij-internet-rostov001.ru

тарифы интернет и телевидение ростов

olympe casino en ligne: olympe casino avis – casino olympe

интернет провайдер ростов

domashij-internet-rostov002.ru

подключить проводной интернет ростов

olympe: olympe casino – olympe casino en ligne

olympe casino olympe casino

casino olympe: olympe casino – olympe casino avis

olympe: olympe casino avis – olympe casino en ligne

провайдеры домашнего интернета ростов

domashij-internet-rostov003.ru

домашний интернет тарифы ростов

casino olympe olympe

casino olympe: olympe casino cresus – casino olympe

подключить интернет в волгограде в квартире

domashij-internet-volgograd001.ru

домашний интернет омск

olympe casino en ligne: olympe casino cresus – olympe

olympe casino avis olympe casino en ligne

olympe casino en ligne: casino olympe – olympe casino

casino olympe: olympe casino en ligne – casino olympe

тарифы интернет и телевидение омск

domashij-internet-volgograd002.ru

подключить домашний интернет в волгограде

olympe casino en ligne olympe casino cresus

casino olympe: olympe casino – olympe casino en ligne

olympe casino cresus: olympe casino cresus – olympe

подключить домашний интернет в волгограде

domashij-internet-volgograd003.ru

интернет провайдер омск

olympe casino cresus casino olympe

olympe casino: olympe – olympe casino en ligne

домашний интернет в воронеже

domashij-internet-voronezh001.ru

подключить домашний интернет в воронеже

olympe casino avis olympe

olympe: casino olympe – olympe

Balduin Groller,Die Tante und der Onkel.エロ 人形

подключить домашний интернет в воронеже

domashij-internet-voronezh002.ru

подключить проводной интернет воронеж

olympe olympe

olympe casino avis: olympe casino cresus – olympe casino en ligne

olympe casino: olympe casino avis – olympe casino

интернет домашний воронеж

domashij-internet-voronezh003.ru

интернет тарифы воронеж

olympe casino olympe

olympe casino: olympe casino – olympe casino

olympe casino cresus: olympe casino cresus – olympe casino

kamagra gel achat kamagra kamagra oral jelly

https://tadalmed.shop/# Cialis generique prix

pharmacies en ligne certifiГ©es: Meilleure pharmacie en ligne – pharmacie en ligne fiable pharmafst.com

kamagra gel: kamagra livraison 24h – achat kamagra

pharmacie en ligne france fiable Meilleure pharmacie en ligne Achat mГ©dicament en ligne fiable pharmafst.shop

https://kamagraprix.shop/# kamagra en ligne

acheter mГ©dicament en ligne sans ordonnance: Medicaments en ligne livres en 24h – pharmacie en ligne fiable pharmafst.com

Cialis sans ordonnance pas cher: Cialis sans ordonnance 24h – Cialis sans ordonnance 24h tadalmed.shop

Cialis sans ordonnance pas cher Pharmacie en ligne Cialis sans ordonnance Cialis generique prix tadalmed.com

https://pharmafst.com/# pharmacie en ligne france pas cher

cialis generique: Cialis en ligne – cialis prix tadalmed.shop

Theythe women,ラブドール えろI meanare out of itshould be out of i We must helpthem to stay in that beautiful world of their own,

Achetez vos kamagra medicaments: Kamagra Oral Jelly pas cher – Kamagra pharmacie en ligne

and the guests,女性 用 ラブドールleavingtheir seats,

https://pharmafst.com/# п»їpharmacie en ligne france

vente de mГ©dicament en ligne Medicaments en ligne livres en 24h pharmacie en ligne sans ordonnance pharmafst.shop

Acheter Viagra Cialis sans ordonnance: Tadalafil 20 mg prix sans ordonnance – Achat Cialis en ligne fiable tadalmed.shop

achat kamagra: Acheter Kamagra site fiable – Acheter Kamagra site fiable

https://kamagraprix.com/# kamagra 100mg prix

kamagra 100mg prix: acheter kamagra site fiable – Kamagra Commander maintenant

Acheter Viagra Cialis sans ordonnance cialis sans ordonnance Acheter Cialis tadalmed.com

Cialis sans ordonnance 24h: Cialis sans ordonnance 24h – Tadalafil 20 mg prix en pharmacie tadalmed.shop

https://tadalmed.shop/# Cialis generique prix

えろ 人形to find a je or asa Spaniel ranges the field,till he find a sent,

whichafterwards ruled my destiny,I find it arise,ロボット セックス

pharmacie en ligne pas cher: pharmacie en ligne sans ordonnance – pharmacie en ligne france pas cher pharmafst.com

Acheter Kamagra site fiable achat kamagra Acheter Kamagra site fiable

pharmacie en ligne fiable: pharmacies en ligne certifiГ©es – pharmacie en ligne livraison europe pharmafst.com

http://pharmafst.com/# pharmacie en ligne fiable

Cialis sans ordonnance 24h: Acheter Viagra Cialis sans ordonnance – Cialis sans ordonnance 24h tadalmed.shop

Cialis sans ordonnance pas cher Cialis en ligne Cialis en ligne tadalmed.com

Cialis sans ordonnance 24h: Achat Cialis en ligne fiable – Cialis sans ordonnance 24h tadalmed.shop

http://tadalmed.com/# Acheter Cialis 20 mg pas cher

Cialis sans ordonnance 24h: Cialis sans ordonnance 24h – Acheter Cialis 20 mg pas cher tadalmed.shop

pharmacie en ligne france fiable pharmacie en ligne sans ordonnance Pharmacie Internationale en ligne pharmafst.shop

acheter kamagra site fiable: kamagra gel – Kamagra pharmacie en ligne

https://kamagraprix.com/# Acheter Kamagra site fiable

cialis sans ordonnance: Acheter Cialis 20 mg pas cher – Cialis sans ordonnance 24h tadalmed.shop

acheter mГ©dicament en ligne sans ordonnance: pharmacie en ligne – Pharmacie sans ordonnance pharmafst.com

acheter mГ©dicament en ligne sans ordonnance Livraison rapide pharmacie en ligne livraison europe pharmafst.shop

Cialis sans ordonnance 24h: Tadalafil achat en ligne – Cialis sans ordonnance pas cher tadalmed.shop

pharmacie en ligne france livraison belgique: Pharmacies en ligne certifiees – pharmacie en ligne france fiable pharmafst.com

pharmacie en ligne avec ordonnance: pharmacie en ligne france livraison internationale – Pharmacie Internationale en ligne pharmafst.com

https://pharmafst.com/# pharmacie en ligne avec ordonnance

Kamagra Oral Jelly pas cher kamagra livraison 24h kamagra livraison 24h

Achat Cialis en ligne fiable: Acheter Cialis – cialis generique tadalmed.shop

kamagra gel: achat kamagra – Kamagra pharmacie en ligne

kamagra oral jelly: kamagra 100mg prix – Acheter Kamagra site fiable

https://tadalmed.com/# cialis prix

kamagra gel: Achetez vos kamagra medicaments – Kamagra pharmacie en ligne

kamagra pas cher Kamagra Oral Jelly pas cher Kamagra Commander maintenant

kamagra oral jelly: kamagra pas cher – kamagra en ligne

kamagra livraison 24h: Kamagra Oral Jelly pas cher – Kamagra Oral Jelly pas cher

cialis prix: cialis generique – Tadalafil sans ordonnance en ligne tadalmed.shop

https://pharmafst.shop/# Achat mГ©dicament en ligne fiable

Kamagra Commander maintenant kamagra pas cher achat kamagra

Kamagra Oral Jelly pas cher: Kamagra Commander maintenant – kamagra 100mg prix

pharmacie en ligne livraison europe: Medicaments en ligne livres en 24h – п»їpharmacie en ligne france pharmafst.com

Pharmacie en ligne Cialis sans ordonnance: Achat Cialis en ligne fiable – Achat Cialis en ligne fiable tadalmed.shop

https://tadalmed.com/# Cialis generique prix

Cialis generique prix: Acheter Cialis 20 mg pas cher – Acheter Cialis tadalmed.shop

Pharmacie Internationale en ligne Medicaments en ligne livres en 24h pharmacies en ligne certifiГ©es pharmafst.shop

п»їpharmacie en ligne france: Medicaments en ligne livres en 24h – Pharmacie Internationale en ligne pharmafst.com

Kamagra Commander maintenant: acheter kamagra site fiable – kamagra gel

https://pharmafst.com/# pharmacie en ligne pas cher

Acheter Viagra Cialis sans ordonnance: Cialis sans ordonnance pas cher – Cialis en ligne tadalmed.shop

Tadalafil 20 mg prix sans ordonnance Acheter Viagra Cialis sans ordonnance Cialis generique prix tadalmed.com

Achetez vos kamagra medicaments: Kamagra Commander maintenant – kamagra gel

https://kamagraprix.com/# kamagra en ligne

kamagra livraison 24h: Kamagra Oral Jelly pas cher – kamagra pas cher

п»їpharmacie en ligne france: pharmacie en ligne – pharmacie en ligne france fiable pharmafst.com

Yes,高級 ダッチワイフI had gone to bedHenry I had awakened Edward Hyde.

ラブドールand pester the foreman with unnecessaryquestions.(5) Do your work poorly and blame it on bad tools,

a very poor way indeed.ラブドール 激安But I am one of thosethat never take on about princely fortunes,

Thu gentlethough an inlander,人形 エロSteelkilt was wild-ocean born,

wth Barney at the wheel.Her sprts rose rapdly as they tore along.ラブドール 高級

Tadalafil 20 mg prix en pharmacie: cialis generique – Tadalafil sans ordonnance en ligne tadalmed.shop

Acheter Viagra Cialis sans ordonnance: Pharmacie en ligne Cialis sans ordonnance – Tadalafil sans ordonnance en ligne tadalmed.shop

and maddened by his long entombment in a place asblack as the bowels of despair,ラブドール おすすめit was then that Steelkilt proposed tothe two Canallers,

pharmacie en ligne livraison europe pharmacie en ligne sans ordonnance п»їpharmacie en ligne france pharmafst.shop

but it would not do: in half a minute the letterwas unfolded again,and collecting herself as well as she could,ラブドール 風俗

https://kamagraprix.shop/# Acheter Kamagra site fiable

pharmacie en ligne france fiable: pharmacie en ligne sans ordonnance – pharmacie en ligne pas cher pharmafst.com

Tadalafil sans ordonnance en ligne: cialis sans ordonnance – Cialis sans ordonnance pas cher tadalmed.shop

pharmacies en ligne certifiГ©es: pharmacie en ligne sans ordonnance – pharmacie en ligne avec ordonnance pharmafst.com

http://tadalmed.com/# Tadalafil 20 mg prix sans ordonnance

Kamagra pharmacie en ligne Acheter Kamagra site fiable Kamagra Commander maintenant

pharmacie en ligne pas cher: Livraison rapide – pharmacie en ligne livraison europe pharmafst.com

kamagra oral jelly: kamagra oral jelly – kamagra 100mg prix

https://kamagraprix.shop/# Acheter Kamagra site fiable

Cialis sans ordonnance 24h: Cialis sans ordonnance pas cher – cialis sans ordonnance tadalmed.shop

https://pharmafst.com/# Achat mГ©dicament en ligne fiable

Pharmacie en ligne Cialis sans ordonnance: Tadalafil 20 mg prix en pharmacie – Cialis sans ordonnance 24h tadalmed.shop

https://kamagraprix.shop/# Kamagra Commander maintenant

Cialis sans ordonnance 24h: cialis generique – Tadalafil 20 mg prix sans ordonnance tadalmed.shop

Cialis sans ordonnance 24h: Cialis sans ordonnance pas cher – Cialis sans ordonnance 24h tadalmed.shop

https://tadalmed.shop/# Cialis sans ordonnance pas cher

Cialis en ligne: Cialis sans ordonnance 24h – Pharmacie en ligne Cialis sans ordonnance tadalmed.shop

cialis sans ordonnance: Acheter Cialis – Pharmacie en ligne Cialis sans ordonnance tadalmed.shop

Tadalafil sans ordonnance en ligne: Acheter Cialis 20 mg pas cher – Cialis sans ordonnance pas cher tadalmed.shop

https://pharmafst.shop/# п»їpharmacie en ligne france

kamagra gel kamagra 100mg prix kamagra 100mg prix

Achat Cialis en ligne fiable: Tadalafil 20 mg prix sans ordonnance – Cialis sans ordonnance 24h tadalmed.shop

kamagra gel: kamagra pas cher – kamagra 100mg prix

trouver un mГ©dicament en pharmacie: pharmacie en ligne – п»їpharmacie en ligne france pharmafst.com

https://kamagraprix.com/# Acheter Kamagra site fiable

Cialis generique prix: cialis generique – Acheter Cialis tadalmed.shop

kamagra 100mg prix: kamagra en ligne – Achetez vos kamagra medicaments

Achat mГ©dicament en ligne fiable pharmacie en ligne pas cher pharmacies en ligne certifiГ©es pharmafst.shop

mexico drug stores pharmacies: Rx Express Mexico – RxExpressMexico

Rx Express Mexico: mexican online pharmacies prescription drugs – RxExpressMexico

mexican online pharmacy: mexico pharmacies prescription drugs – mexican rx online

Medicine From India Medicine From India indian pharmacy online

https://expressrxcanada.shop/# buy prescription drugs from canada cheap

mexican online pharmacy: RxExpressMexico – RxExpressMexico

canadian 24 hour pharmacy: Express Rx Canada – canadian pharmacy ltd

pharmacy com canada: Express Rx Canada – canadian pharmacy ltd

https://expressrxcanada.com/# online canadian pharmacy reviews

canadian discount pharmacy Express Rx Canada pharmacy canadian

best rated canadian pharmacy: best canadian online pharmacy – northwest canadian pharmacy

indian pharmacy online: indian pharmacy online shopping – medicine courier from India to USA

indian pharmacy online: indian pharmacy – Medicine From India

https://expressrxcanada.shop/# real canadian pharmacy

legit canadian pharmacy: Express Rx Canada – canadian pharmacy checker

india online pharmacy indian pharmacy online indian pharmacy online

Medicine From India: Online medicine home delivery – medicine courier from India to USA

RxExpressMexico: Rx Express Mexico – mexico drug stores pharmacies

Mula sa unangaraw ng inyng pagdating dito’y inyng sinactan ang calooban ng isangfraileng cabalitaan sa mga taong siya’y isang banal,at ipinalalagayng canyang mga capuwa fraileng siya’y isang pantas.ストッキング エロ

nguni’t piniguil ang tulin ng canyang paglacad ng pagiingatna baca siya’y maino.Hindi pa siya nacalalayo ng malaki ng marinig niyang siya’y canilangtinatawag ng boong cabangisan.ストッキング エロ

at sa pagca’t hindisila macasumpong ng aliw saan m canilang pinupuno ang alangalangng mga sigaw at panambitan.Nagculng ang cura sa pagca’t may sakit,ランジェリー エロ

https://rxexpressmexico.shop/# mexico pharmacies prescription drugs

canadian discount pharmacy: Express Rx Canada – canadian pharmacy meds

Rx Express Mexico mexico pharmacy order online mexico pharmacy order online

rate canadian pharmacies: Canadian pharmacy shipping to USA – canadian drugstore online

reputable indian pharmacies: indian pharmacy online shopping – indian pharmacy

エッチ な コスプレon est arrivé.? Et dansune des plus grandes promenades que nous faisions de Combray,

http://rxexpressmexico.com/# mexican online pharmacy

indian pharmacy: MedicineFromIndia – indian pharmacy online

mexico pharmacies prescription drugs: RxExpressMexico – Rx Express Mexico

indian pharmacy online shopping indian pharmacy online shopping indian pharmacy

medicine courier from India to USA: medicine courier from India to USA – Online medicine order

Medicine From India: Medicine From India – MedicineFromIndia

MedicineFromIndia: MedicineFromIndia – indian pharmacy online shopping

Rx Express Mexico mexico drug stores pharmacies mexican online pharmacy

https://expressrxcanada.com/# best canadian pharmacy online

MedicineFromIndia: medicine courier from India to USA – medicine courier from India to USA

indian pharmacy online shopping: п»їlegitimate online pharmacies india – medicine courier from India to USA

indian pharmacy online: medicine courier from India to USA – medicine courier from India to USA

http://medicinefromindia.com/# indian pharmacy online

canadian pharmacy no scripts Express Rx Canada rate canadian pharmacies

canadian online pharmacy: Generic drugs from Canada – canadian pharmacy oxycodone

Medicine From India: medicine courier from India to USA – MedicineFromIndia

http://pinuprus.pro/# пинап казино

pin up: pin up azerbaycan – pinup az

пин ап вход пин ап зеркало пин ап вход

пин ап казино: пин ап вход – пин ап вход

http://pinupaz.top/# pin up

вавада: вавада казино – вавада

vavada: вавада – вавада зеркало

pin up az pinup az pin up az

https://pinuprus.pro/# пин ап вход

vavada: вавада официальный сайт – вавада казино

pin-up: pin-up casino giris – pin-up casino giris

пин ап казино pin up вход пин ап казино

https://pinuprus.pro/# пин ап вход

пинап казино: pin up вход – pin up вход

пин ап вход пин ап казино официальный сайт пин ап казино

вавада казино: vavada casino – вавада зеркало

pin up az: pin up az – pinup az

pin up casino: pin-up casino giris – pin up azerbaycan

pin up вход пин ап казино официальный сайт пин ап казино

https://vavadavhod.tech/# вавада

vavada casino: vavada – вавада казино

pin up вход: пин ап зеркало – пин ап вход

vavada casino: вавада – vavada вход

вавада казино vavada casino вавада зеркало

vavada casino: vavada – vavada

vavada: вавада казино – вавада

пин ап вход: пин ап вход – пин ап казино

вавада vavada вход vavada casino

vavada casino: vavada casino – вавада зеркало

https://pinupaz.top/# pin up azerbaycan

продажа аккаунтов соцсетей перепродажа аккаунтов

vavada вход: vavada casino – вавада зеркало

pin up azerbaycan: pin-up casino giris – pin up azerbaycan

аккаунты с балансом маркетплейс аккаунтов

маркетплейс для реселлеров https://magazin-akkauntov-online.ru/

пин ап зеркало: пин ап казино – пинап казино

пин ап вход пинап казино пин ап казино официальный сайт

http://vavadavhod.tech/# vavada вход

вавада: вавада зеркало – вавада официальный сайт

pin up вход: пинап казино – пин ап вход

купить аккаунт с прокачкой магазин аккаунтов

pin up вход: пинап казино – пин ап казино официальный сайт

https://pinuprus.pro/# пинап казино

пин ап вход: пин ап казино – пинап казино

пин ап зеркало пин ап зеркало пин ап вход

вавада: вавада официальный сайт – вавада официальный сайт

безопасная сделка аккаунтов https://prodat-akkaunt-online.ru/

vavada casino: вавада официальный сайт – vavada вход

услуги по продаже аккаунтов заработок на аккаунтах

https://vavadavhod.tech/# vavada casino

купить аккаунт с прокачкой магазин аккаунтов

vavada: вавада официальный сайт – вавада казино

vavada vavada вавада официальный сайт

пин ап зеркало: пинап казино – пин ап казино

https://pinupaz.top/# pin up az

пин ап казино официальный сайт: пинап казино – пин ап казино официальный сайт

пин ап казино официальный сайт pin up вход пинап казино

пин ап казино: пин ап казино официальный сайт – пинап казино

pin up azerbaycan: pin up az – pin up

http://pinuprus.pro/# пин ап казино

пинап казино: pin up вход – пинап казино

pin up вход пин ап вход пинап казино

http://vavadavhod.tech/# vavada вход

Account exchange Profitable Account Sales

Account market Account market

pin up azerbaycan: pin up azerbaycan – pin up azerbaycan

пин ап казино пинап казино пинап казино

Find Accounts for Sale Account Selling Service

pin up azerbaycan: pinup az – pin-up

http://pinuprus.pro/# пин ап вход

Find Accounts for Sale Accounts marketplace

пин ап казино: пин ап вход – пин ап казино официальный сайт

пин ап зеркало пин ап казино пин ап зеркало

vavada casino: вавада – vavada вход

http://vavadavhod.tech/# vavada

Профессиональный сервисный центр по ремонту Apple iPhone в Москве.

Мы предлагаем: ремонт айфона в москве недорого

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

вавада официальный сайт: vavada – vavada casino

pin up az pin up pin up az

pin up вход: пин ап зеркало – пинап казино

https://pinupaz.top/# pin-up casino giris

пин ап вход: pin up вход – пин ап казино

pinup az pin-up pin up casino

pin-up: pin-up casino giris – pinup az

http://pinuprus.pro/# пин ап казино официальный сайт

Website for Buying Accounts Buy accounts

Sell Account Account Trading

Account exchange Account Trading Service

вавада казино: вавада – vavada вход

пин ап вход: pin up вход – пин ап вход

pin up pinup az pin up

http://vavadavhod.tech/# vavada

pin up вход: пин ап вход – пин ап казино официальный сайт

http://vavadavhod.tech/# vavada casino

вавада казино: вавада официальный сайт – вавада зеркало

vavada вход вавада зеркало вавада зеркало

Online Account Store Account Selling Service

Secure Account Sales Account Store

pin-up casino giris: pinup az – pin up azerbaycan

Gaming account marketplace Secure Account Sales

https://pinupaz.top/# pin up

вавада зеркало vavada вход вавада зеркало

pinup az: pin-up casino giris – pin-up casino giris

vavada casino: vavada вход – вавада

https://pinupaz.top/# pin up azerbaycan

пин ап казино пин ап вход пин ап казино

вавада официальный сайт: vavada casino – vavada casino

pinup az: pin-up – pin up

http://vavadavhod.tech/# vavada

вавада зеркало вавада зеркало vavada

пин ап казино: пин ап казино – пин ап вход

пин ап зеркало: пин ап зеркало – пин ап вход

account trading account market

find accounts for sale accounts for sale

https://pinuprus.pro/# пин ап казино официальный сайт

profitable account sales buy pre-made account

пин ап вход пин ап казино официальный сайт пин ап казино официальный сайт

интернет домашний челябинск

chelyabinsk-domashnij-internet002.ru

подключение интернета челябинск

vavada casino: vavada – vavada

вавада казино: вавада казино – вавада зеркало

http://pinupaz.top/# pinup az

account market sell account

домашний интернет челябинск

chelyabinsk-domashnij-internet003.ru

домашний интернет тарифы

pin up az pin up az pin-up

pin-up: pin-up – pin up azerbaycan

подключение интернета екатеринбург

ekaterinburg-domashnij-internet001.ru

интернет провайдеры по адресу екатеринбург

http://pinupaz.top/# pin-up

セックス ドールEr war w?hrend dieser Zeit mit allerleizurechtgeschneiderten abgelegten Kleidungsstücken sauber ausstaffiert,Stine hatte ihm von der Wolle,

s palace of a house was like AuntRebecca,s brown clapboarded house.リアルラブドール

проверить провайдера по адресу

ekaterinburg-domashnij-internet002.ru

интернет по адресу дома

高級 ラブドールSouthward from the Straits of Juan de Fuca,an eighty-mile-longarm of the Pacific penetrates the State of Washingtonthat is PugetSound.

пин ап казино: пин ап казино официальный сайт – пин ап казино

вавада вавада казино вавада зеркало

pin up: pinup az – pin up azerbaycan

often,リアルラブドールt know when.

https://pinuprus.pro/# пин ап казино

провайдеры интернета по адресу

ekaterinburg-domashnij-internet003.ru

домашний интернет тарифы екатеринбург

ラブドール 通販tdo a thing I ask! s always six o,clock now.

エロ 人形Es k?nnte sie nur glücklich machen,wenn sie’s s?he,

buy accounts online account store

marketplace for ready-made accounts profitable account sales

pinup az: pin-up casino giris – pin up

purchase ready-made accounts website for selling accounts

pin-up casino giris pinup az pin up azerbaycan

http://vavadavhod.tech/# вавада официальный сайт

pin up az: pin-up casino giris – pin up azerbaycan

проверить провайдера по адресу

kazan-domashnij-internet002.ru

проверить интернет по адресу

accounts marketplace accounts market

вавада официальный сайт: вавада официальный сайт – вавада казино

пинап казино пин ап зеркало пин ап зеркало

подключение интернета по адресу

kazan-domashnij-internet003.ru

интернет тарифы казань

http://vavadavhod.tech/# вавада зеркало

pin-up: pin-up – pin-up

pin up casino: pin-up – pin up casino

провайдеры по адресу красноярск

krasnoyarsk-domashnij-internet001.ru

провайдеры интернета по адресу

account exchange service account buying platform

https://pinupaz.top/# pin up casino

pin up pin up azerbaycan pin up az

пин ап казино официальный сайт: пин ап вход – пинап казино

purchase ready-made accounts account selling platform

account store account exchange

провайдеры интернета по адресу

krasnoyarsk-domashnij-internet002.ru

интернет по адресу

pin up: pin up – pinup az

http://pinupaz.top/# pin-up casino giris

провайдеры интернета в красноярске по адресу

krasnoyarsk-domashnij-internet003.ru

провайдеры интернета в красноярске по адресу проверить

pin up вход pin up вход pin up вход

вавада зеркало: вавада казино – vavada

вавада казино: вавада – вавада зеркало

узнать провайдера по адресу краснодар

krasnodar-domashnij-internet001.ru

проверить провайдеров по адресу краснодар

account exchange marketplace for ready-made accounts

account selling service account catalog

buy pre-made account accounts for sale

https://vavadavhod.tech/# vavada casino

провайдеры в краснодаре по адресу проверить

krasnodar-domashnij-internet002.ru

провайдеры интернета в краснодаре по адресу

guaranteed accounts social media account marketplace

pinup az pin up azerbaycan pin up az

pin-up casino giris: pinup az – pin-up casino giris

вавада официальный сайт: вавада – вавада официальный сайт

http://pinuprus.pro/# pin up вход

интернет тарифы москва

msk-domashnij-internet001.ru

какие провайдеры на адресе в москве

пин ап казино официальный сайт: пин ап зеркало – пин ап вход

pin-up pin-up casino giris pin-up casino giris

pin up azerbaycan: pinup az – pin-up casino giris

account marketplace account marketplace

secure account sales social-accounts-marketplace.org

http://vavadavhod.tech/# вавада официальный сайт

ダッチワイフ リアル(i) Brakes and Miscellaneous(1) Engines should run at high speeds and use brakes excessively atcurves and on downhill grades.(2) Punch holes in air-brake valves or water supply pipes.

and you will use or they wouldt have given you the room youhave–s a family roo do you see? Guests never are put in this wingof the house,not outside guest ?explained ?said but she did not see in the least.高級 ダッチワイフ

pin-up: pin up – pin-up casino giris

вавада казино вавада казино vavada вход

vavada casino: vavada – vavada вход

熟女 ラブドールthen walked to getmy wind.I was already tired.

интернет по адресу

msk-domashnij-internet002.ru

подключить домашний интернет в москве

http://pinupaz.top/# pin-up

?“Ohyou,オナホ 高級re Jordan Baker.

高級 ダッチワイフchild? ?she added,turning to Beth.

проверить провайдеров по адресу москва

msk-domashnij-internet003.ru

подключить интернет тарифы москва

вавада казино: вавада – вавада официальный сайт

database of accounts for sale verified accounts for sale

вавада казино вавада vavada casino

account buying service marketplace for ready-made accounts

пинап казино: пин ап вход – пин ап казино официальный сайт

account selling service account sale

https://vavadavhod.tech/# вавада

провайдеры в нижнем новгороде по адресу проверить

nizhnij-novgorod-domashnij-internet001.ru

интернет провайдеры нижний новгород

пинап казино: пин ап казино официальный сайт – пин ап казино официальный сайт

пин ап зеркало pin up вход пин ап казино

интернет провайдер нижний новгород

nizhnij-novgorod-domashnij-internet002.ru

интернет провайдеры по адресу нижний новгород

pin up casino: pin-up casino giris – pin up azerbaycan

https://pinupaz.top/# pin-up casino giris

провайдеры интернета в нижнем новгороде по адресу

nizhnij-novgorod-domashnij-internet003.ru

проверить провайдеров по адресу нижний новгород

вавада казино: vavada – вавада

pinup az: pin-up – pin-up casino giris

pin up azerbaycan pin up az pinup az

проверить интернет по адресу

novosibirsk-domashnij-internet001.ru

провайдер по адресу новосибирск

http://pinuprus.pro/# пин ап зеркало

account market buy accounts

buy pre-made account purchase ready-made accounts

secure account sales account market

провайдеры интернета по адресу новосибирск

novosibirsk-domashnij-internet002.ru

провайдеры в новосибирске по адресу проверить

pin up az: pin up azerbaycan – pin-up

an absent parent,セックス 人形mental illness,

海外 セックスand in rare cases,they saw their dead pet.

split them off into breeds,and tailored them to do the jobs we needed them to do.ダッチワイフ エロ

pin-up casino giris: pin up – pin up azerbaycan

провайдеры интернета в новосибирске

novosibirsk-domashnij-internet003.ru

домашний интернет тарифы новосибирск

пинап казино пин ап вход пин ап зеркало

Dogs and cats are great sources of comfort and companionship.However,ラブドール 中古

https://pinupaz.top/# pin up

подключить интернет омск

omsk-domashnij-internet001.ru

интернет домашний омск

What we are willing to give of ourselves sexually is perhaps one of the most profound ways that our behavior speaks of love,or doesn’t.オナニー 用

” I had no idea I’d ever be writing a second edition,ラブドール 販売but 17 years later,

вавада официальный сайт: vavada – vavada

account trading service purchase ready-made accounts

пин ап вход: пин ап вход – пинап казино

интернет тарифы омск

omsk-domashnij-internet002.ru

подключить интернет в омске в квартире

https://pinupaz.top/# pin up az

pinup az pin up pin-up

marketplace for ready-made accounts profitable account sales

провайдеры домашнего интернета омск

omsk-domashnij-internet003.ru

подключить интернет в омске в квартире

social media account marketplace account sale

secure account sales verified accounts for sale

пин ап казино официальный сайт: пин ап казино – пинап казино

pinup az: pin up – pin up azerbaycan

https://pinupaz.top/# pin up azerbaycan

интернет домашний пермь

perm-domashnij-internet001.ru

дешевый интернет пермь

подключить домашний интернет в перми

perm-domashnij-internet002.ru

домашний интернет тарифы

generic tadalafil discreet shipping ED pills cheap Cialis online

интернет тарифы пермь

perm-domashnij-internet003.ru

недорогой интернет пермь

generic sildenafil 100mg: no doctor visit required – trusted Viagra suppliers

generic tadalafil: discreet shipping ED pills – cheap Cialis online

http://zipgenericmd.com/# affordable ED medication

провайдеры интернета в ростове

rostov-domashnij-internet001.ru

подключить интернет в ростове в квартире

modafinil legality Modafinil for sale modafinil 2025

Cialis without prescription: discreet shipping ED pills – cheap Cialis online

cheap Cialis online: generic tadalafil – best price Cialis tablets

подключить интернет в ростове в квартире

rostov-domashnij-internet002.ru

подключить интернет в ростове в квартире

http://modafinilmd.store/# legal Modafinil purchase

purchase Modafinil without prescription: buy modafinil online – purchase Modafinil without prescription

legit Viagra online: same-day Viagra shipping – buy generic Viagra online

order Viagra discreetly secure checkout Viagra order Viagra discreetly

guaranteed accounts account market

doctor-reviewed advice: purchase Modafinil without prescription – modafinil legality

buy and sell accounts https://accounts-marketplace.xyz/

какие провайдеры по адресу

samara-domashnij-internet001.ru

провайдер интернета по адресу самара

Viagra without prescription: order Viagra discreetly – buy generic Viagra online

account catalog https://buy-best-accounts.org

https://modafinilmd.store/# buy modafinil online

same-day Viagra shipping: cheap Viagra online – order Viagra discreetly

интернет провайдеры по адресу самара

samara-domashnij-internet002.ru

интернет провайдеры по адресу

generic tadalafil cheap Cialis online secure checkout ED drugs

fast Viagra delivery: same-day Viagra shipping – trusted Viagra suppliers

account exchange service https://social-accounts-marketplaces.live

modafinil pharmacy: modafinil legality – purchase Modafinil without prescription

какие провайдеры по адресу

samara-domashnij-internet003.ru

интернет провайдеры в самаре по адресу дома

fast Viagra delivery: secure checkout Viagra – cheap Viagra online

Modafinil for sale purchase Modafinil without prescription modafinil legality

account catalog account marketplace

подключить проводной интернет санкт-петербург

spb-domashnij-internet001.ru

домашний интернет тарифы

purchase ready-made accounts https://social-accounts-marketplace.xyz

buy modafinil online: modafinil 2025 – buy modafinil online

order Viagra discreetly: fast Viagra delivery – order Viagra discreetly

website for selling accounts https://buy-accounts.space/

safe online pharmacy: order Viagra discreetly – generic sildenafil 100mg

подключить интернет в квартиру санкт-петербург

spb-domashnij-internet002.ru

какие провайдеры на адресе в санкт-петербурге

no doctor visit required same-day Viagra shipping cheap Viagra online

https://maxviagramd.shop/# buy generic Viagra online

人形 エロspending his vacation in seas far remotefrom his periodical feeding-grounds,should turn up his wrinkled browoff the Persian Gulf,

Viagra without prescription: fast Viagra delivery – trusted Viagra suppliers

ラブドール おすすめwhyden you be angel,for all angel is not,

order Viagra discreetly: Viagra without prescription – best price for Viagra

дешевый интернет санкт-петербург

spb-domashnij-internet003.ru

домашний интернет тарифы

reliable online pharmacy Cialis: order Cialis online no prescription – Cialis without prescription

modafinil 2025 modafinil legality safe modafinil purchase

какие провайдеры интернета есть по адресу уфа

ufa-domashnij-internet001.ru

интернет по адресу

modafinil pharmacy: legal Modafinil purchase – purchase Modafinil without prescription

https://maxviagramd.com/# fast Viagra delivery

人形 エロBy that circular,it appears that precisely such a chart is in course of completion,

and the youth,with tools differentfrom those he had used in the morning,ダッチワイフ

account exchange service https://buy-accounts-shop.pro/

discreet shipping ED pills: online Cialis pharmacy – online Cialis pharmacy

best price Cialis tablets: discreet shipping ED pills – Cialis without prescription

интернет по адресу уфа

ufa-domashnij-internet002.ru

проверить провайдера по адресу

best price for Viagra: buy generic Viagra online – generic sildenafil 100mg

generic sildenafil 100mg fast Viagra delivery safe online pharmacy

https://zipgenericmd.shop/# FDA approved generic Cialis

secure account sales https://buy-accounts.live

провайдеры интернета в уфе по адресу

ufa-domashnij-internet003.ru

провайдеры интернета по адресу

discreet shipping: generic sildenafil 100mg – legit Viagra online

website for buying accounts https://social-accounts-marketplace.live

secure account sales https://accounts-marketplace.online

Viagra without prescription: trusted Viagra suppliers – safe online pharmacy

trusted Viagra suppliers: order Viagra discreetly – safe online pharmacy

интернет домашний омск

volgograd-domashnij-internet001.ru

недорогой интернет омск

trusted Viagra suppliers legit Viagra online buy generic Viagra online

https://zipgenericmd.com/# FDA approved generic Cialis

лучший интернет провайдер омск

volgograd-domashnij-internet002.ru

домашний интернет омск

legal Modafinil purchase: verified Modafinil vendors – modafinil 2025

modafinil pharmacy: doctor-reviewed advice – doctor-reviewed advice

affordable ED medication: generic tadalafil – order Cialis online no prescription

провайдеры домашнего интернета омск

volgograd-domashnij-internet003.ru

подключить интернет в квартиру омск

http://maxviagramd.com/# fast Viagra delivery

Viagra without prescription legit Viagra online no doctor visit required

best price for Viagra: cheap Viagra online – order Viagra discreetly

they’re not only comfortable but also perfect for the bedroom.Pair them with the matching bralette to complete the look.sexy velma

недорогой интернет воронеж

voronezh-domashnij-internet001.ru

интернет тарифы воронеж

same-day Viagra shipping: order Viagra discreetly – cheap Viagra online

order Viagra discreetly: cheap Viagra online – order Viagra discreetly

as many of our collections also have ballet inspiration,sexy velma cosplayderived from designer Angela’s early career in the costume department of the New York City Ballet.

интернет провайдер воронеж

voronezh-domashnij-internet002.ru

подключить интернет в квартиру воронеж

https://modafinilmd.store/# modafinil legality

no doctor visit required trusted Viagra suppliers order Viagra discreetly

affordable ED medication: Cialis without prescription – discreet shipping ED pills

order Cialis online no prescription: buy generic Cialis online – generic tadalafil

домашний интернет воронеж

voronezh-domashnij-internet003.ru

провайдеры интернета в воронеже

Modafinil for sale: modafinil 2025 – buy modafinil online

http://maxviagramd.com/# generic sildenafil 100mg

интернет провайдеры челябинск

chelyabinsk-domashnij-internet001.ru

провайдеры интернета в челябинске

generic sildenafil 100mg: cheap Viagra online – generic sildenafil 100mg

modafinil legality buy modafinil online verified Modafinil vendors

affordable ED medication: buy generic Cialis online – secure checkout ED drugs

account market https://accounts-marketplace-best.pro

домашний интернет челябинск

chelyabinsk-domashnij-internet002.ru

подключить проводной интернет челябинск

legal Modafinil purchase: doctor-reviewed advice – purchase Modafinil without prescription

http://maxviagramd.com/# Viagra without prescription

маркетплейс аккаунтов https://akkaunty-na-prodazhu.pro/

no doctor visit required: cheap Viagra online – order Viagra discreetly

fast Viagra delivery: secure checkout Viagra – cheap Viagra online

площадка для продажи аккаунтов магазины аккаунтов

тарифы интернет и телевидение челябинск

chelyabinsk-domashnij-internet003.ru

интернет провайдер челябинск

verified Modafinil vendors modafinil pharmacy purchase Modafinil without prescription

маркетплейс аккаунтов https://kupit-akkaunt.xyz

провайдер интернета по адресу екатеринбург

ekaterinburg-domashnij-internet001.ru

домашний интернет

where can you get amoxicillin: order amoxicillin online – Amo Health Care

Amo Health Care Amo Health Care Amo Health Care

https://prednihealth.com/# PredniHealth

cost of clomid: order clomid no prescription – generic clomid for sale

where to buy clomid: how to buy clomid without prescription – where can i get generic clomid

подключить интернет екатеринбург

ekaterinburg-domashnij-internet002.ru

подключить интернет

amoxicillin 250 mg price in india: Amo Health Care – amoxicillin 500mg buy online uk

проверить интернет по адресу

ekaterinburg-domashnij-internet003.ru

подключить интернет екатеринбург

amoxicillin 30 capsules price: buy amoxicillin online no prescription – amoxicillin 825 mg

https://amohealthcare.store/# Amo Health Care

how to get amoxicillin: where to buy amoxicillin 500mg – Amo Health Care

10mg prednisone daily PredniHealth 10 mg prednisone tablets

провайдеры интернета в казани по адресу проверить

kazan-domashnij-internet001.ru

дешевый интернет казань

cost of generic clomid price: Clom Health – generic clomid

биржа аккаунтов https://akkaunt-magazin.online/

can you get clomid tablets: Clom Health – clomid medication

https://prednihealth.shop/# 54 prednisone

купить аккаунт akkaunty-market.live

clomid medication: Clom Health – get cheap clomid without a prescription

can i buy generic clomid Clom Health where buy clomid no prescription

маркетплейс аккаунтов https://kupit-akkaunty-market.xyz

medicine prednisone 10mg: PredniHealth – prednisone prescription drug

лучший интернет провайдер казань

kazan-domashnij-internet003.ru

интернет провайдеры в казани по адресу дома

clomid no prescription: Clom Health – where buy cheap clomid without insurance

PredniHealth: 60 mg prednisone daily – 20 mg prednisone

https://clomhealth.com/# cost of generic clomid no prescription

провайдеры интернета в красноярске по адресу проверить

krasnoyarsk-domashnij-internet001.ru

провайдеры интернета в красноярске по адресу проверить

how to buy clomid without rx [url=https://clomhealth.shop/#]Clom Health[/url] can you get cheap clomid without prescription

can i order clomid online: Clom Health – where to get clomid price

интернет провайдеры красноярск по адресу

krasnoyarsk-domashnij-internet002.ru

подключение интернета по адресу

where can i buy generic clomid without prescription: Clom Health – get clomid now

https://prednihealth.com/# prednisone online

провайдеры по адресу дома

krasnoyarsk-domashnij-internet003.ru

интернет по адресу красноярск

prednisone 60 mg price PredniHealth PredniHealth

PredniHealth: PredniHealth – 20mg prednisone

проверить провайдеров по адресу краснодар

krasnodar-domashnij-internet001.ru

какие провайдеры на адресе в краснодаре

rexall pharmacy amoxicillin 500mg: Amo Health Care – Amo Health Care

https://amohealthcare.store/# medicine amoxicillin 500

узнать провайдера по адресу краснодар

krasnodar-domashnij-internet002.ru

провайдеры интернета в краснодаре по адресу

магазин аккаунтов https://akkaunty-optom.live

prednisone online PredniHealth PredniHealth

маркетплейс аккаунтов https://online-akkaunty-magazin.xyz

amoxicillin 825 mg: Amo Health Care – amoxil generic

PredniHealth: 20 mg prednisone tablet – prednisone 40 mg tablet

покупка аккаунтов маркетплейсов аккаунтов

проверить провайдера по адресу

krasnodar-domashnij-internet003.ru

интернет по адресу краснодар

http://prednihealth.com/# PredniHealth

подключение интернета москва

msk-domashnij-internet001.ru